This contra account holds a reserve, similar to the allowance for doubtful accounts. For each debit against the inventory account, there will be a corresponding credit against the obsolete inventory contra account. While accumulated depreciation is the most common contra asset account, the following also may apply, depending https://kelleysbookkeeping.com/how-to-categorize-expenses-for-small-business/ on the company. A less common example of a contra asset account is Discount on Notes Receivable. The credit balance in this account is amortized or allocated to Interest Income or Interest Revenue over the life of a note receivable. This type of account could be called the allowance for doubtful accounts or bad debt reserve.

Contra Account Definition, Types, and Example – Investopedia

Contra Account Definition, Types, and Example.

Posted: Mon, 13 Feb 2023 08:00:00 GMT [source]

Offsetting the asset account with its respective contra asset account shows the net balance of that asset. Whereas assets normally have positive debit balances, contra assets, though still reported along with other assets, have an opposite type of natural balance. Some of the most common contra assets include accumulated depreciation, allowance for doubtful accounts, and reserve for obsolete inventory. The contra asset account, accumulated depreciation, is always a credit balance.

Contra Asset

There are four key types of contra accounts—contra asset, contra liability, contra equity, and contra revenue. Contra assets decrease the balance of a fixed or capital asset, carrying a credit balance. Contra liabilities reduce liability accounts and carry a debit balance. Contra revenue accounts reduce revenue accounts and have a debit balance.

- Get instant access to video lessons taught by experienced investment bankers.

- These three types of contra accounts are used to reduce liabilities, equity, and revenue which all have natural credit balances.

- However, that $1.4 billion is used to reduce the balance of gross accounts receivable.

- Allowance for doubtful accounts reduce accounts receivable, while accumulated deprecation is used to reduce the value of a fixed asset.

- A contra account enables a company to report the original amount while also reporting the appropriate downward adjustment.

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

Why are contra asset accounts important for businesses?

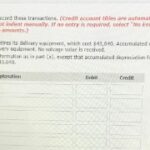

When a contra asset account is not stated separately in the balance sheet, it may be worthwhile to disclose the amount in the accompanying footnotes, where readers can readily see it. When a contra asset account is first recorded in a journal entry, the offset is to an expense. For example, an increase in the form of a credit to allowance for doubtful accounts is also recorded as a debit to increase bad debt expense. A contra asset is a negative asset account that offsets the asset account with which it is paired.

The natural balance in a contra asset account is a credit balance, as opposed to the natural debit balance in all other asset accounts. There is no reason for there to ever be a debit balance in a contra asset account; thus, a debit balance probably indicates an incorrect accounting entry. When a contra asset transaction is created, the offset is a charge to the income statement, which reduces profits. There are three contra asset accounts that commonly appear in an organization’s chart of accounts. It is paired with the trade accounts receivable account, and contains a reserve for receivables that are unlikely to be paid by customers.

AccountingTools

Most accountants choose to record the depreciation over the useful life of an item in the accumulated depreciation contra asset account, which is a credit account. The balance sheet would show the piece of equipment at its historical cost, then subtract the accumulated depreciation to reflect the accurate value of the asset. Contra assets are accounts in the general ledger—where you enter your transactions—that carry a balance used to offset the account with which it is paired. Instead of debiting the asset account directly, the contra asset account balance will be credited (reduced) separately.

- Contra asset accounts include allowance for doubtful accounts and accumulated depreciation.

- A contra liability is an account in which activity is recorded as a debit balance is used to decrease the balance of a liability.

- Contra liability, equity, and revenue accounts have natural debit balances.

- Often when a company extends goods on credit, management expects some of those customers not to pay and so anticipates writing off bad debt.

- Key examples of contra asset accounts include allowance for doubtful accounts and accumulated depreciation.

Accumulated depreciation is a contra account because it subtracts from the asset. Allowance for doubtful accounts is a contra account because it subtracts from the asset accounts receivable. If you offer credit terms to your customers, you probably know that not all of them will pay. Creating this contra asset account builds in a safeguard against overstating your accounts receivable balance.

Definition of Contra Asset Account

Those who are struggling with recording contra accounts may benefit from utilizing some of the best accounting software currently available. Accounts receivable (A/R) has a debit balance, but the allowance for doubtful accounts carries a credit

balance. Whether reported as separate lines on the financial report or as a cumulative value, the net amount of the pair of accounts is called the “net book value” of the individual asset. Still, the dollar amounts are separately broken out in the supplementary sections most of the time for greater transparency in financial reporting.

The proper size of a contra asset account can be the subject of considerable discussion between a company controller and the company’s auditors. The auditors want to ensure that reserves are adequate, while the controller is more inclined to keep reserves low in order to increase the reported profit level. The allowance method of accounting allows a company to estimate what amount is reasonable to book into the contra account.

What Is the Benefit of Using a Contra Account?

The purpose of a contra asset account is to store a reserve that reduces the balance in the paired account. By stating this information separately in a contra asset account, a user of financial information can see the extent to which a paired asset should be reduced. The account Allowance What Is A Contra Asset Account? for Doubtful Account is credited when the account Bad Debts Expense is debited under the allowance method. The use of Allowance for Doubtful Accounts allows us to see in Accounts Receivable the total amount that the company has a right to collect from its credit customers.